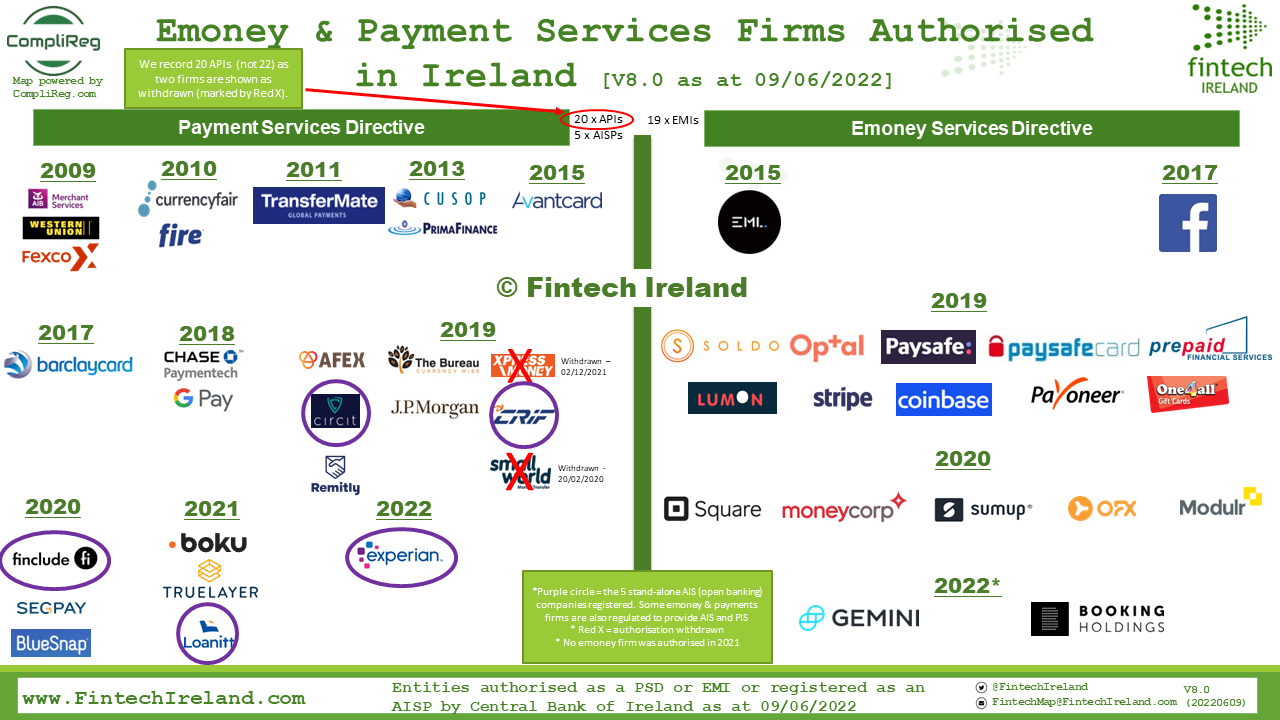

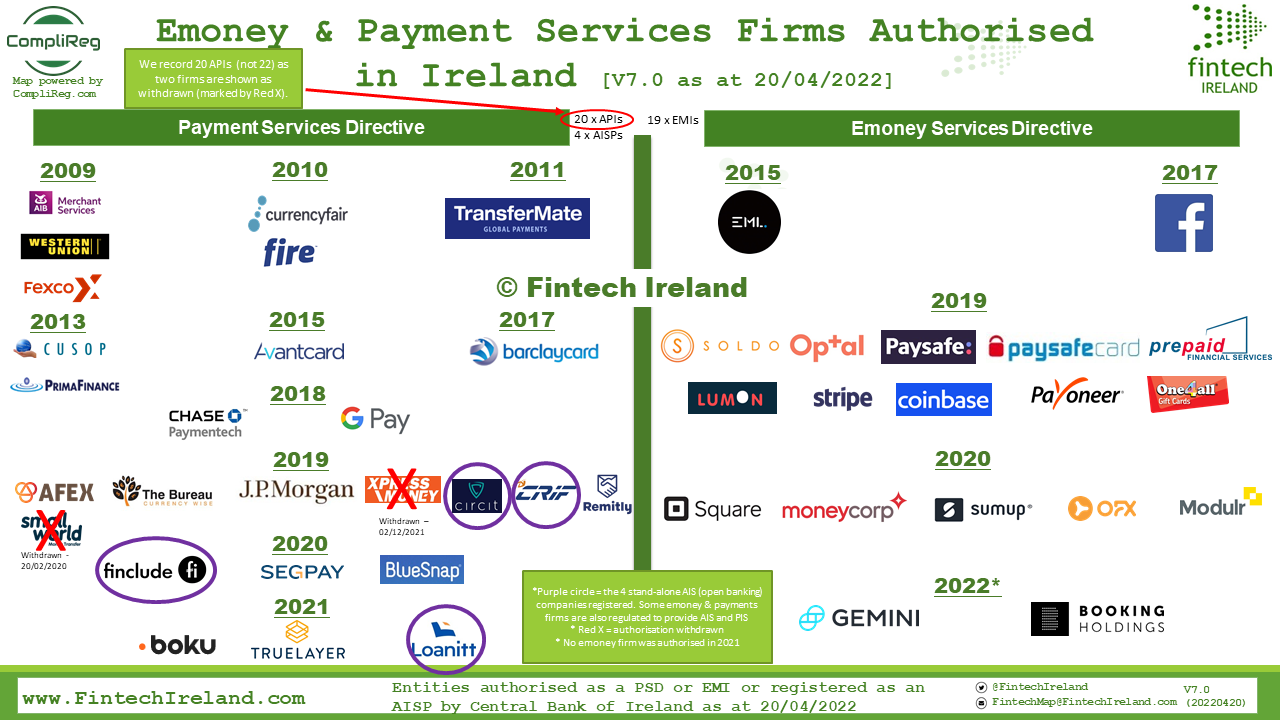

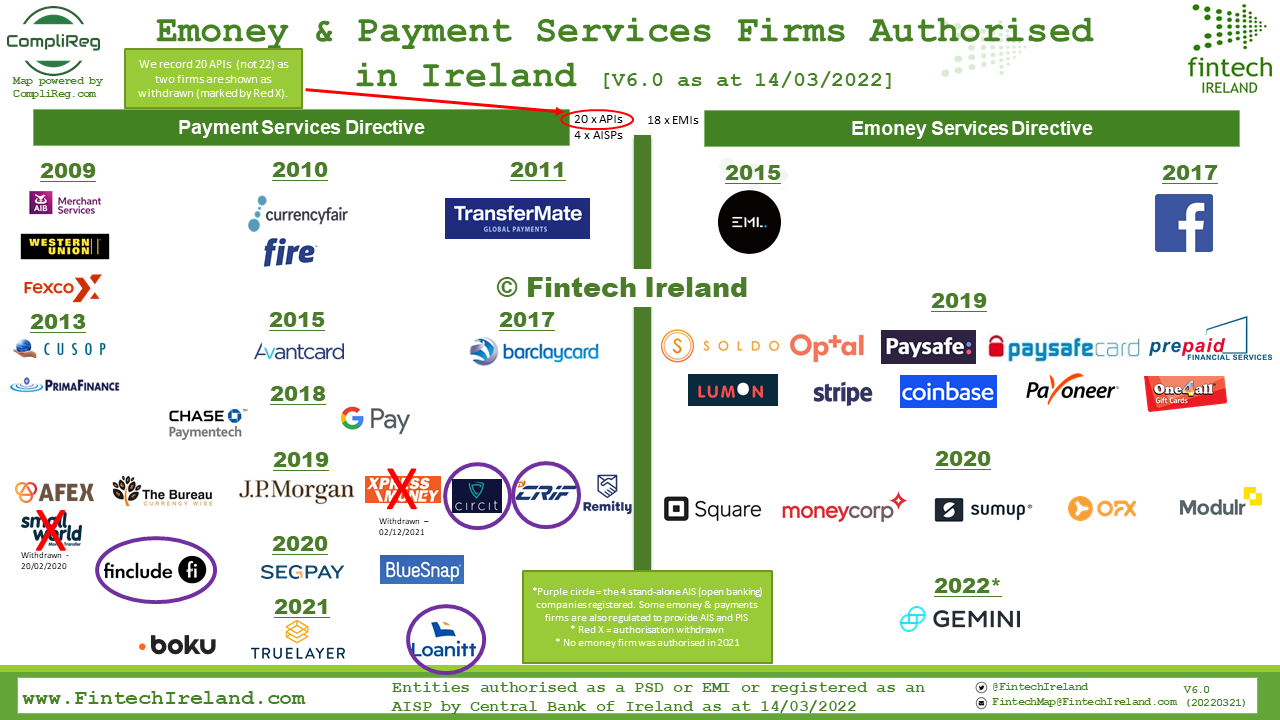

Thus far in 2022, the Central Bank of Ireland has only authorised two emoney firms and registered one AISP. So far no payment services firm has been authorised in Ireland in 2022 as we enter the second half of the year.

Experian Ireland was incorporated in Ireland since 1997. According to CRO filings, the company's turnover for the year ended March 2021 was € 3.71mn up from €5.4mn, recording a loss of €111,000 against a profit in the previous year of $1.34mn.

The register reflects that as at 30 June 2022, the doesn't presently passport services across the European Union.

As at 30 June 2022, Ireland is now home to 19 authorised electronic money institutions, 20 authorised payment institutions and 5 standalone account information service providers. We have updated our regulated fintech Map to version 8.0 where we showcase these firms.

Our Peter Oakes spoke with Charlie Taylor of the Business Post on Sunday 3 July 2022 about the registration of Experian Ireland as an AISP:

- "The news was also welcomed by Peter Oakes, a former Central Bank enforcement director and founder of Fintech Ireland, an industry group."Irish customers will be able to share transactional information from their bank account with other banks and third parties. Customers will be able to better monitor, control and improve the way their banking data is used, including managing their so-called ‘credit score’ when looking for financing.

- “We are yet to see the fruits of open banking in Ireland to the same degree as elsewhere. Together with other fintechs providing open banking, Irish consumers and small businesses will enjoy more choice in an increasingly competitive landscape," Oakes said.

Further Reading: See also Charlie Taylor's article on the authorisation of emoney and payment services firms and the issues firms are facing getting authorised in Ireland in his article of 10 April 2022 titled Defensive attitude of Central Bank putting off fintech investors. And see our News posts of:

- 25 April 2022 on the announcement of Bookings Holding becoming an authorised emoney firm; and

- 10 April 2022 titled Defensive attitude of Central Bank putting off fintech investors.